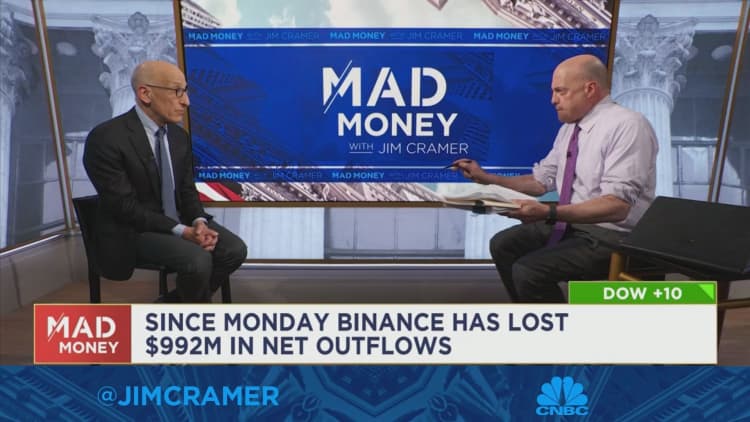

Binance’s Co-founder & CEO Changpeng Zhao has given a number of interviews discussing the outlook for cryptocurrency following a turbulent couple of weeks out there.

NurPhoto / Contributor / Getty Photographs

The $2.2 billion of U.S. buyer belongings held by Binance is at “vital danger” of being stolen by founder Changpeng Zhao until a freezing order is in put place, federal regulators stated in a submitting Tuesday evening, after the crypto regulator was charged by the Securities and Alternate Fee.

Legal professionals from the SEC filed an emergency movement earlier, citing a risk of capital flight and asking a choose to repatriate and freeze U.S. buyer belongings to forestall illicit transfers by Zhao or Binance entities. The SEC sued Binance and Zhao on Monday, alleging they engaged within the unregistered provide and sale of securities and commingled investor funds with their very own.

The most recent submitting described Zhao as a “overseas nationwide who has made overt his views that he’s not topic to the jurisdiction of this Court docket.” SEC legal professionals alleged that two Binance U.S. subsidiaries — BAM Buying and selling and BAM Administration — have been managed by Zhao and had already garnered “illicit features” of not less than $420.4 million in earnings and enterprise fundraising.

Years of communications between the SEC and Binance, which claims no official headquarters, recommend that Binance.US could not clearly point out who managed buyer belongings, in accordance with the submitting.

“Zhao and Binance have had free reign,” the SEC alleged, over “buyer belongings price billions of {dollars}.”

Zhao’s attorneys say the billionaire is just not topic to U.S. regulation, regardless of his management over or useful possession of U.S. corporations and financial institution accounts that despatched billions of {dollars} to Swiss and British Virgin Islands-based holding corporations, the SEC stated.

The SEC says federal regulation and precedent set up the courtroom’s jurisdiction over Zhao and Binance.

“There isn’t any doubt that the Court docket has private jurisdiction over all Defendants,” the SEC stated.

Whereas Binance’s U.S. arm has stated it maintains management over a lot of its know-how and monetary infrastructure, the SEC says Zhao’s final management places investor belongings in danger until motion is taken instantly.

“Given the historical past of Zhao’s and Binance’s open need to keep away from U.S. regulation and oversight, and their surreptitious management over BAM Buying and selling and commingling of and actions of BAM Buying and selling belongings by an online of Zhao-controlled entities exterior of america, there could be no assurance that BAM Buying and selling staff aren’t influenced by Zhao or Binance immediately,” the submitting stated.

Federal regulators are additionally requesting the courtroom permit them to serve Zhao by emailing his legal professionals, saying his “sample of geographical elusiveness” makes it troublesome to establish his actual residence or whereabouts. Zhao is reportedly a resident of the UAE.

Binance didn’t instantly responded to a request for remark.

WATCH: Timothy Massad: crypto risk ‘isn’t just about the token’

Source link

Recent Comments