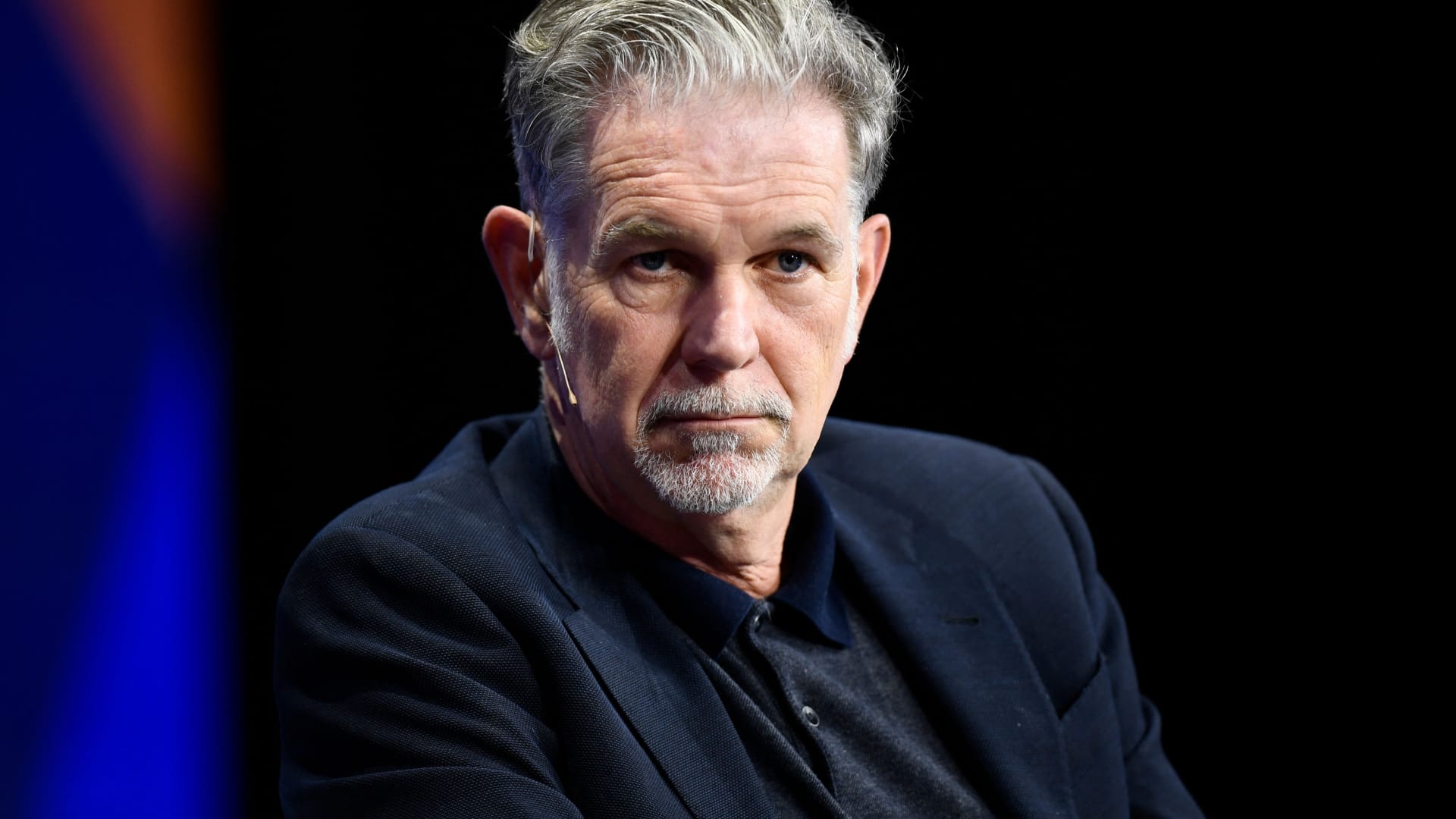

Reed Hastings, co-CEO of Netflix, participates within the Milken Institute World Convention on October 18, 2021 in Beverly Hills, California.

Patrick T. Fallon | AFP | Getty Photos

Netflix on Tuesday posted blended monetary outcomes and stated it was pushing again its broad rollout of its password-sharing crackdown.

Initially, Netflix needed the rollout to happen late within the first quarter, however on Tuesday it stated it will do it within the second quarter.

“Whereas which means a few of the anticipated membership development and income profit will fall in Q3 moderately than Q2, we imagine it will end in a greater consequence from each our members and our enterprise,” the corporate stated in its earnings launch.

The corporate stated it noticed its subscriber development impacted within the worldwide markets the place it has already rolled out such initiatives.

Listed below are the outcomes Netflix reported Tuesday versus estimates from analysts polled by Refinitiv:

- Earnings per share: $2.88 vs $2.86 anticipated

- Income: $8.16 billion vs $8.18 billion anticipated

For the quarter ended March 31, Netflix reported earnings of $1.31 billion, or $2.88 a share, in contrast with $1.6 billion, or $3.53 a share, a yr earlier. Income grew to $8.16 billion from $7.87 billion within the prior-year interval.

Shares of Netflix initially fell greater than 10% however principally recovered in after hours buying and selling.

Netflix’s crackdown on password sharing has been prime of thoughts for traders. Late final yr, the corporate stated it would begin rolling out measures to have individuals who have been borrowing different accounts create their very own.

The corporate has stated greater than 100 million households share accounts, or about 43% of its international consumer base. That has affected its skill to put money into new content material, Netflix has stated. Each the ad-supported possibility and crackdown on password sharing are meant to increase income.

In February, Netflix outlined password-sharing guidance in 4 nations: New Zealand, Canada, Portugal and Spain. The corporate stated it will ask customers in these nations to set a “main location” for his or her accounts, and permit customers to ascertain as much as two “sub accounts” for individuals who do not reside of their residence base for additional charges.

Netflix stated Tuesday it has been happy with its push to mitigate password sharing. In Latin America, the corporate stated it noticed cancellations after the information was introduced, which affected near-term development. However, Netflix added, these password debtors would later activate their very own accounts advert add present members as “additional member” accounts. In consequence, the corporate stated, it’s seeing extra income.

Canada, which is able to possible function a template for the U.S., has seen its membership base develop as a result of launch of paid sharing, and income development has accelerated and “is rising sooner than within the U.S.”

The corporate stated that because it rolls out its paid sharing initiatives, it expects close to time period engagement – which is measured by Nielsen for its ad-supported tier – to “possible shrink modestly.” Nonetheless, the corporate believes it is going to bounce again as its seen in worldwide areas.

Anticipating a income bump

Netflix stated it believes paid sharing will guarantee elevated income sooner or later because it seems to be to enhance its service. On Tuesday, Netflix stated it expects to spend within the vary of roughly $17 billion in 2024 on content material, an indication the streamer is not pulling again like a few of its friends.

Netflix famous on Tuesday that “competitors stays intense as we compete with so many types of leisure.”

On Tuesday, Netflix stated goodbye to what received it began — its DVD mailing enterprise, through which it will ship out the discs in crimson envelopes to clients. The corporate’s CEO Ted Sarandos stated in a weblog put up that it will lastly wind down the DVD enterprise, which “continues to shrink.”

A yr in the past, Netflix had reported its first subscriber loss in a decade, sending its shares on a downward spiral, in addition to these of its media friends. The outcomes pushed Netflix and its streaming rivals to focus on income over subscriber numbers.

As Netflix seemed to spice up its income and subscriber base, it turned its focus to an ad-supported plan, in addition to the password sharing crackdown.

Final November, Netflix unveiled its cheaper tier with commercials, which prices $6.99 a month. The ad-supported tier got here shortly after it misplaced subscribers as streaming competitors ramped up.

Sarandos recently said the corporate is prone to supply a number of ad-supported tiers sooner or later.

Netflix’s ad-supported plan now has a median of 95% of the identical content material as what’s on its commercial-free plans resulting from current licensing offers, the corporate stated Tuesday.

“We’re happy with the present efficiency and trajectory of our per-member promoting economics,” Netflix stated Tuesday.

Source link

Recent Comments